nso stock option tax calculator

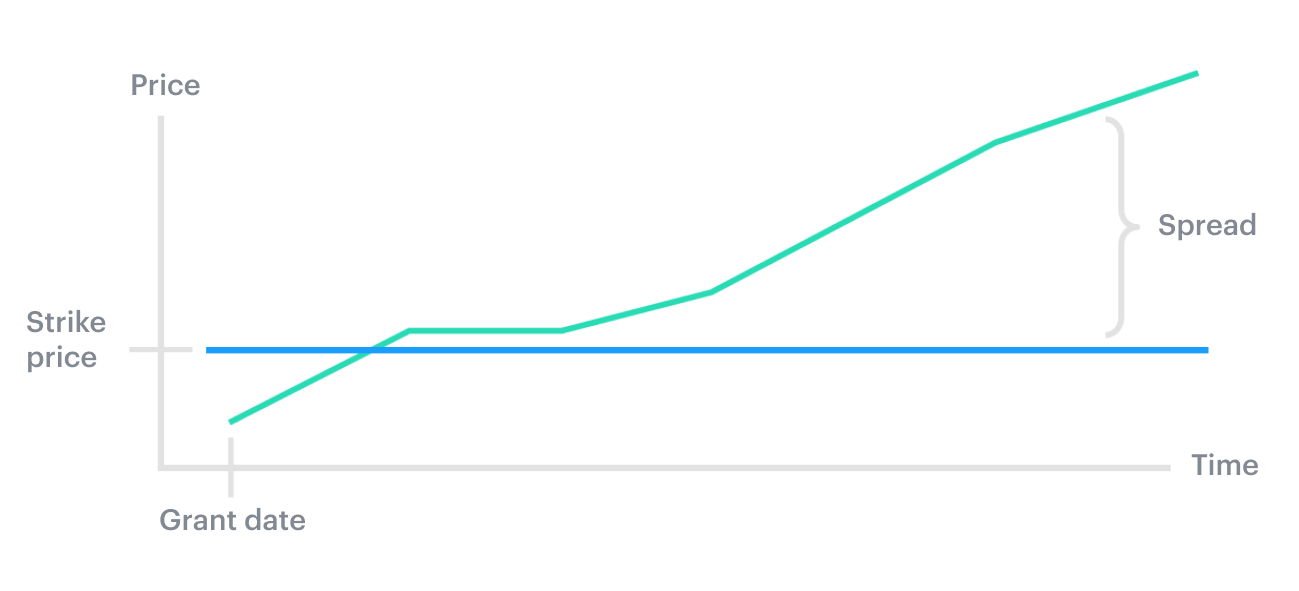

The tool will estimate how much tax youll pay plus your total return on your. How much are your stock options worth.

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

Youve made a 81 net gain on your NSO 150 52 sale tax 17.

. Federal tax 60000 x 25 15000. NSOs do not require employment and. Gain access to the Nasdaq-100 Index at 1100th the notional value.

On this page is a non-qualified stock option or NSO calculator. On this page is an Incentive Stock Options or ISO calculator. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

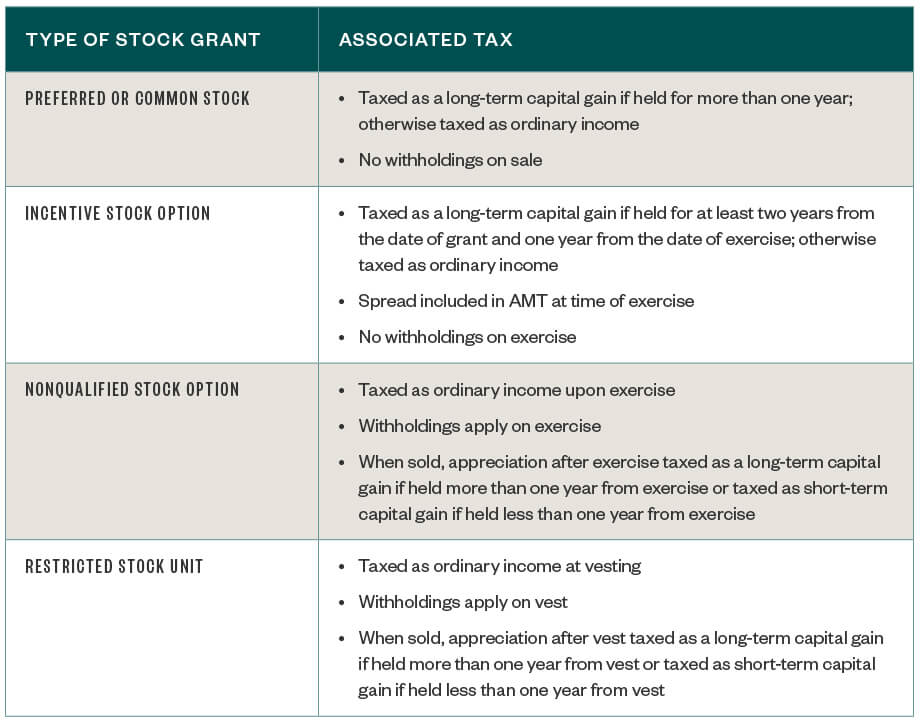

This explains why employee stock options are a type of deferred compensation used to motivate and retain employees. A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders. Stock plans including the non-incentive stock option NSO allow employees to purchase shares of the company at a set price FMV on specific dates to potentially maximize their earnings.

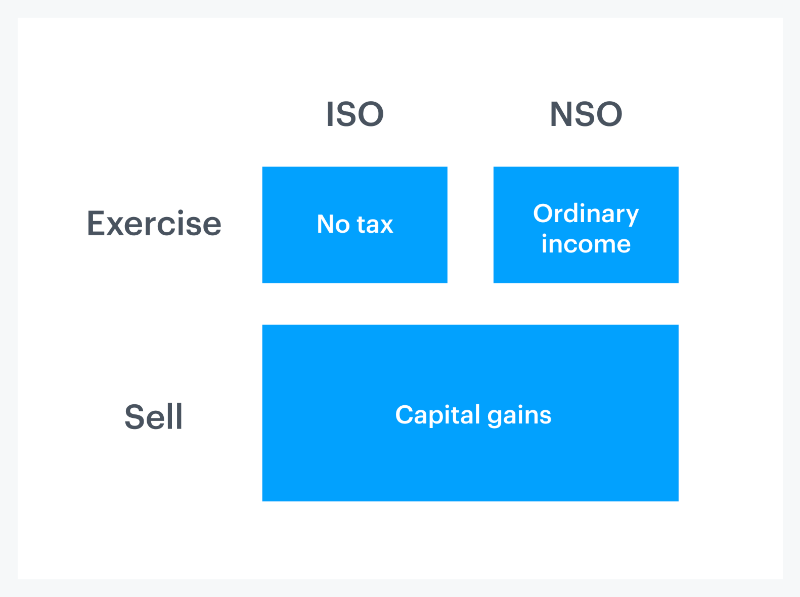

A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike price. The tool will estimate how much tax youll pay plus your total return on. This earned income is also subject to payroll taxes which include Social Security and Medicare.

On this page is a non-qualified stock option or NSO calculator. A stock option is not the same as a share of stock. The calculator is very useful in evaluating the tax implications of a NSO.

Medicare tax 60000 x 145 870. Click to follow the link and save it to your Favorites so. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. On this page is a non-qualified stock option or NSO calculator. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

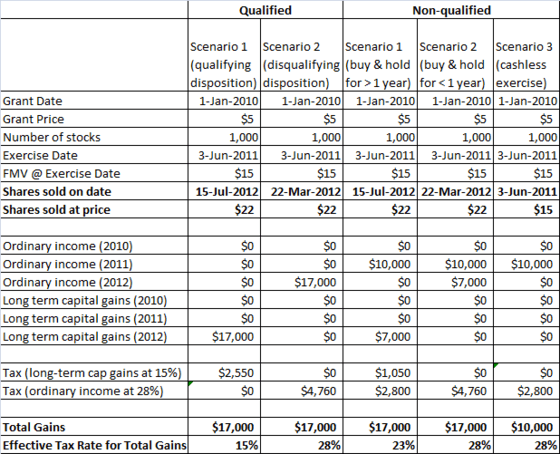

Both an ISO and an NSO are restricted stock. If either is exercised early the holders of these stocks have to pay capitál gains tax whether or not they received cash or just. January 29 2022.

NSOs taxes are withheld at the time of exercise. Redirecting to learnnso-non-qualified-stock-options-tax-treatment 308. NA not sold yet Number of shares.

Ad This dynamic tool forecasts the expected range of the SP 500 Index over the next 30 days. It is also a type of stock-based compensation. Calculate the costs to exercise your stock options - including taxes.

Of course the stock price could fall back to. NSO Tax Occasion 1 - At Exercise. This permalink creates a unique url for this online calculator with your saved information.

A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

A NSO is a type of. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Non-Qualified Stock Option - NSO.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. ISOs are attractive due to their preferential tax. The Stock Option Plan specifies the total number of shares in the option pool.

A stock option is a right to buy a set number of shares of the companys stock at a set price the exercise price within a fixed period of. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. An NSO gives recipients the choice to purchase.

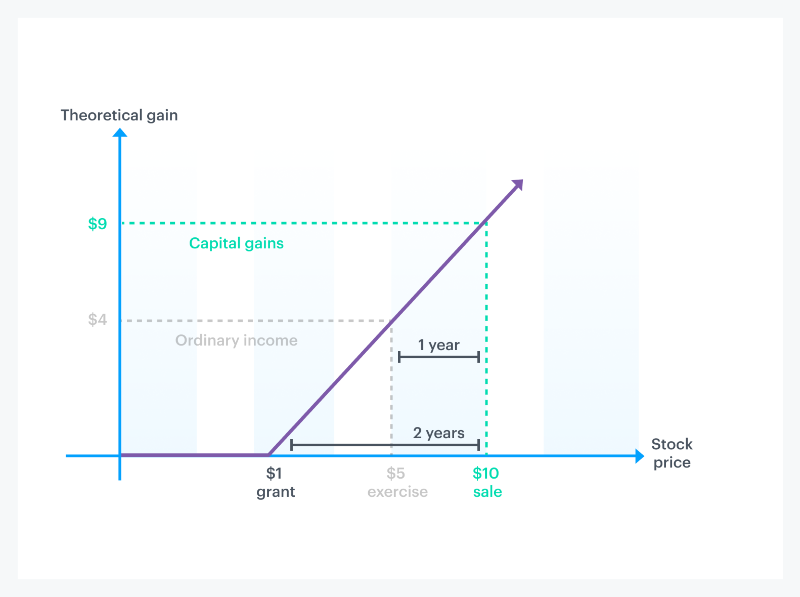

Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you. As an NSO the spread of 0 will be taxed as ordinary income and the company may be able to deduct that amount. Social Security tax 60000 x 62 3720.

Add these three for a total of 19590. Combined with your other income of your total income is 0. The tool will estimate how much tax youll pay plus your total return on your non.

A non-qualified stock option NSO is a type of employee stock option where you pay ordinary income tax on the difference between the grant. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. Stock Option Tax Calculator.

Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock.

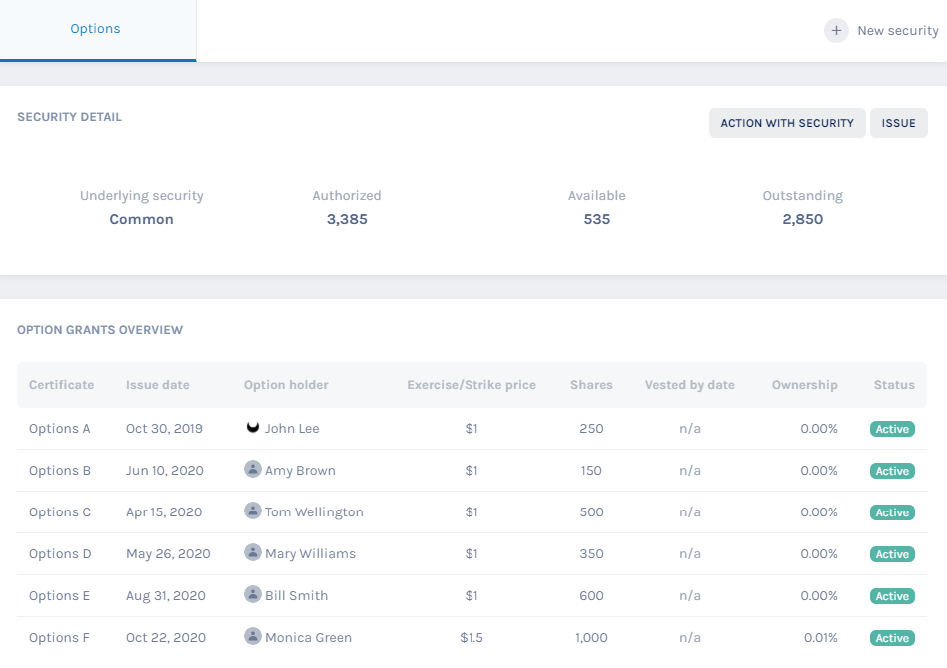

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Stock Options For Startups Founders Board Members Isos Vs Nsos

When Should You Exercise Your Nonqualified Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Non Qualified Stock Options Nsos

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

How Much Are My Options Worth Eso Fund

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

When Should You Exercise Your Nonqualified Stock Options

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

What Are Non Qualified Stock Options Nsos Carta

Tax Planning For Stock Options

How Stock Options Are Taxed Carta

Should I Take An Nso Extension

Stock Options For Startups Founders Board Members Isos Vs Nsos